The actual Sign Up / Sign In button is at the bottom of this document.

Please scroll down to the bottom of this API document for Signing Up / Signing In.

Standard Payroll API - Integration

Introduction

The Standard Payroll API is part of the "1 A Simple Payroll" system, hosted on the Netpaydue.com platform. The "1 A Simple Payroll" system is recognised by HMRC, which ensures that all tax and payroll calculations fully comply with HMRC standards.

Netpaydue.com hosts a wide range of applications and APIs, with the

"1 A Simple Payroll" system and its associated Standard Payroll API being prominent offerings. Established in 2000, Netpaydue.com Ltd is a UK Companies House registered company that has held UKAS ISO 27001 and 9001 certifications for the past 10 years. The company's servers are located in UK data centers, and it adheres to UK GDPR guidelines to ensure data privacy and protection.

Standard Payroll API functionalities:

- Setting up partner clients and employee details for payroll processing.

- Accepting routine timesheets for tax calculations and payroll functions.

- Submitting e-filings, including regular FPS, FSY returns, and Leaver FPS.

- Automatically updating employee tax codes when partners provide HMRC login credentials.

- Generating key reports, such as Employer Payment Reports (EPR) and payslips, accessible via the API.

- Supporting webhook implementations for seamless automated data exchange between systems.

- Offering additional API capabilities through mutual agreement

Technologies Used

The API leverages modern and secure technologies to ensure reliable integration:

- OpenID Connect: Used for authentication, allowing users to verify their identity. It's built on top of OAuth 2.0 and provides an additional identity layer.

- OAuth2: Implemented for authorization, enabling secure delegated access to API resources

- JSON and CSV Formats: Used as appropriate, depending on file size and API call requirements.

- Rate Limiting: Implemented using the Token Bucket Algorithm to ensure fair usage and system stability. The current limit is 1 requests per second per partner, with a burst capacity of 2 requests.

How Standard Payroll API Works

To get started, partners must sign up for the "1 A Simple Payroll" system, create an account, and request API access. After approval, the necessary details for API authorization will be provided.

The API integration process comprises three main components, outlined below:

A. Authentication Integration

Establishing the API link with the system involves using OpenID Connect. This simplifies the coding process and enhances security. Detailed setup instructions will be provided upon approval.

B. Business API Integration

The Business API offers the following core functionalities:

- Client and employee setup.

- Timesheet submissions and tax calculations.

- E-filing services for FPS, FSY, Leaver FPS, and other payroll e-returns.

- Automatic employee tax code updates (HMRC login required).

- Generating essential reports (e.g., payslips, EPR) via API or webhook.

- Customised API functionalities by agreement.

C. Webhook Integration

To optimise API operations, we recommend our partners to implement webhooks alongside their integration with our system. A webhook is essentially a reverse API call, enabling the automatic transmission of agreed-upon data to the partner's system when the processed data is ready or when a status update is available. Our system proactively sends an API request to the partner's server instead of requiring the partner to poll our API repeatedly.

The webhook functionality eliminates the need for partners to make repetitive API calls to retrieve predictable data, improving efficiency. However, implementing a webhook is an optional, pre-arranged feature and does not prevent partners from making standard or additional API calls if needed.

Examples of Webhook Usage

- Timesheet Submission

When a partner submits a timesheet to our system, it is processed instantly. Once processing is complete, our system triggers a webhook call to the partner's designated API URL. This call includes the required data, such as payslips, payment details, or summary reports. - E-Filing FPS Data

When a partner instructs the e-filing of FPS (Full Payment Submission) data, our system processes the request and executes the filing. Following this, a webhook call is sent to the partner's system with a status update, including error reports (if any) and the e-filing completion certificate.

D. Rate Limiting Policy

To ensure fair usage and maintain the stability and performance of our API, we enforce rate limiting. Rate limiting controls the number of requests a partner can make to the API within a specific time frame.

This prevents overuse, ensures equitable access for all users, and protects the system from being overwhelmed.

Help and Support

API Developer Partner Help and Support:

API Developer support is primarily provided via email. However, we recommend that partners schedule a virtual meeting with us at the start to quickly and securely guide you through the setup process for the Authorization API Link.

For any assistance or inquiries, please contact us via email at: api.support@1asimplepayroll.com.

Tronc Payroll Mobile Usage Support:

All API partners can use mobile devices to view and download various data, in addition to retrieving payroll details through API calls. Payroll process monitoring, status checks, and report viewing can all be done via the Tronc Payroll mobile app, available 24/7. You can use the same user credentials from your Tronc API registration to sign in to the mobile app.

A. Authentication Integration

Authentication Integration involves establishing an API link with 1 A Simple Payroll. The required steps are as follows:

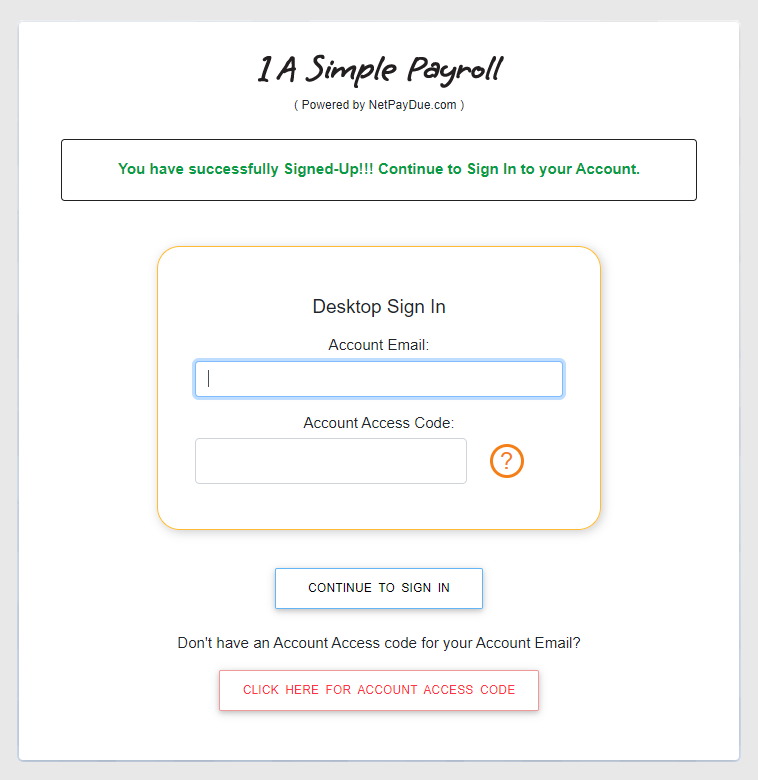

A1) Sign Up

Create an account on 1asimplepayroll.com

- Visit https://www.1asimplepayroll.com/ and click on the Sign Up button.

- Click on the Tronc Payroll Sign Up

button.

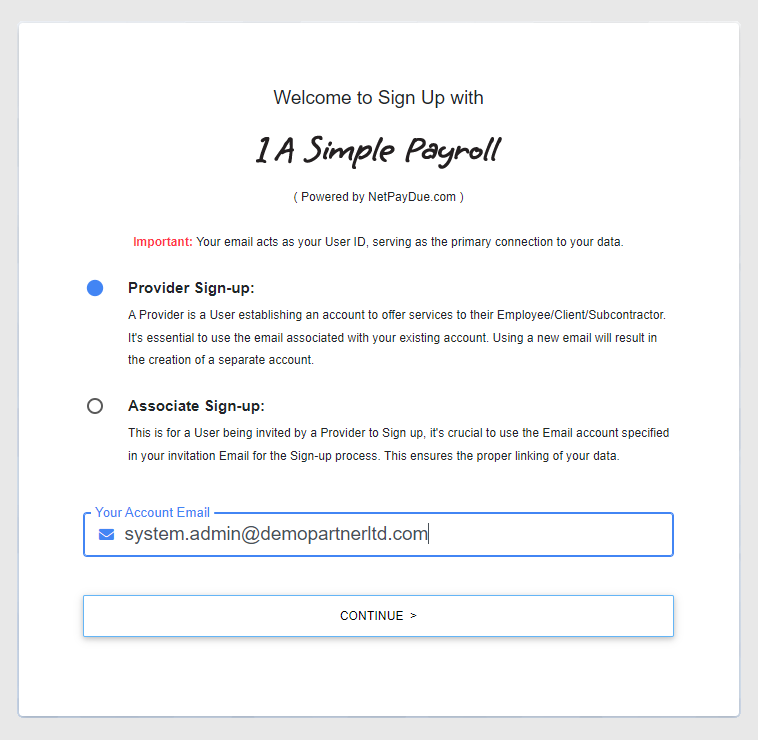

- Select Provider Sign-up option, provide your Email ID to be used for

the user account, and click on the Continue button.

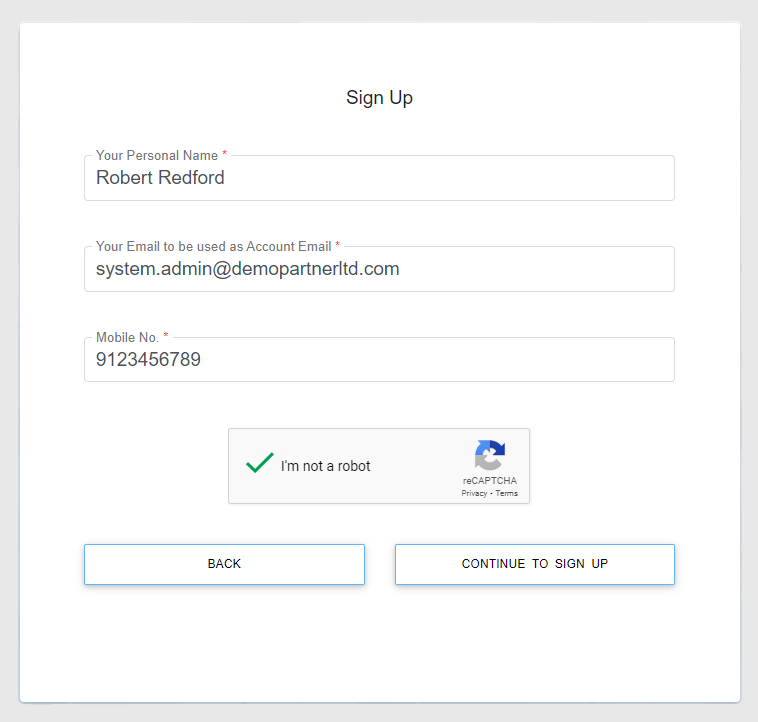

- Enter your personal name, your mobile number, click on "I am not a

robot," and then click on the Continue to Sign Up button.

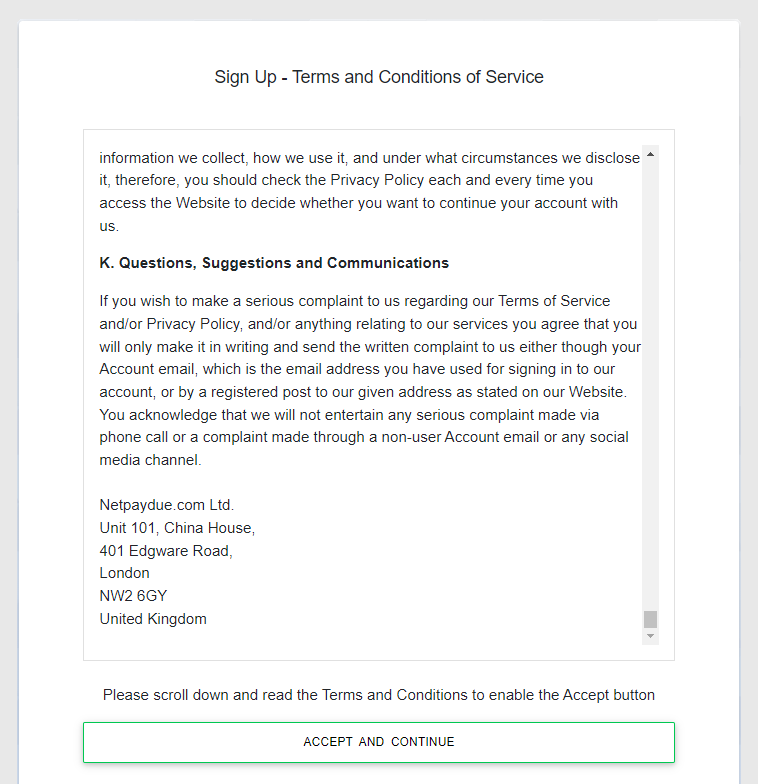

- Read all the terms and conditions and click on Accept and Continue.

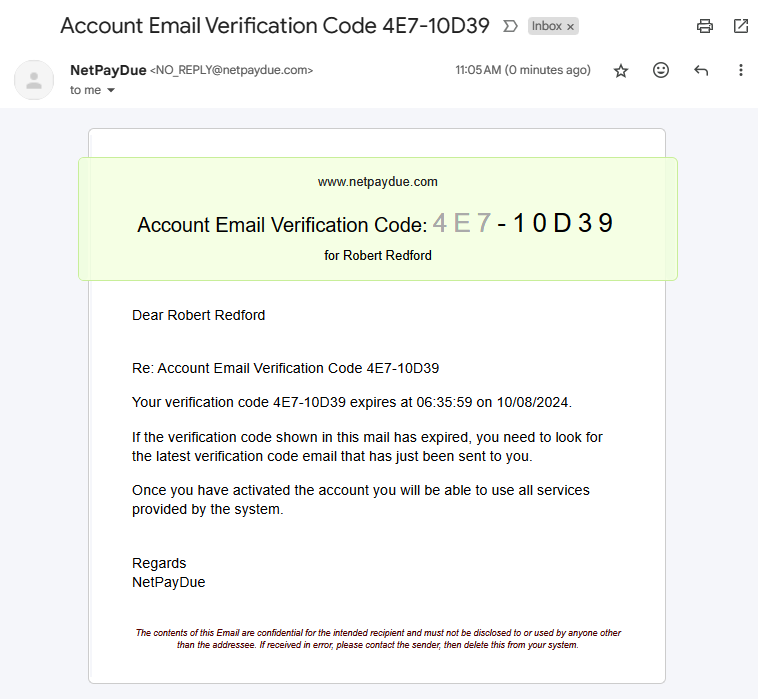

- Sign into your email and check for the Account Email Verification Code

mail in your inbox.

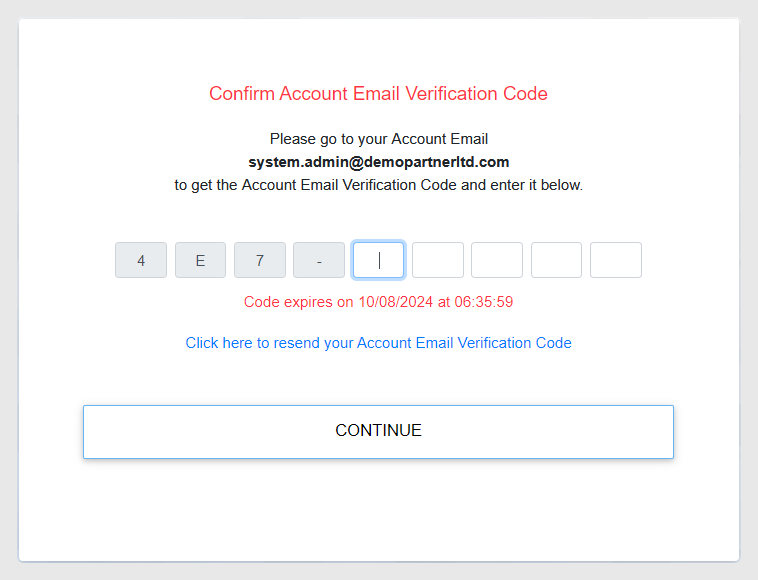

- Enter the last 5 characters of the verification code sent to your email

and click on the Continue button.

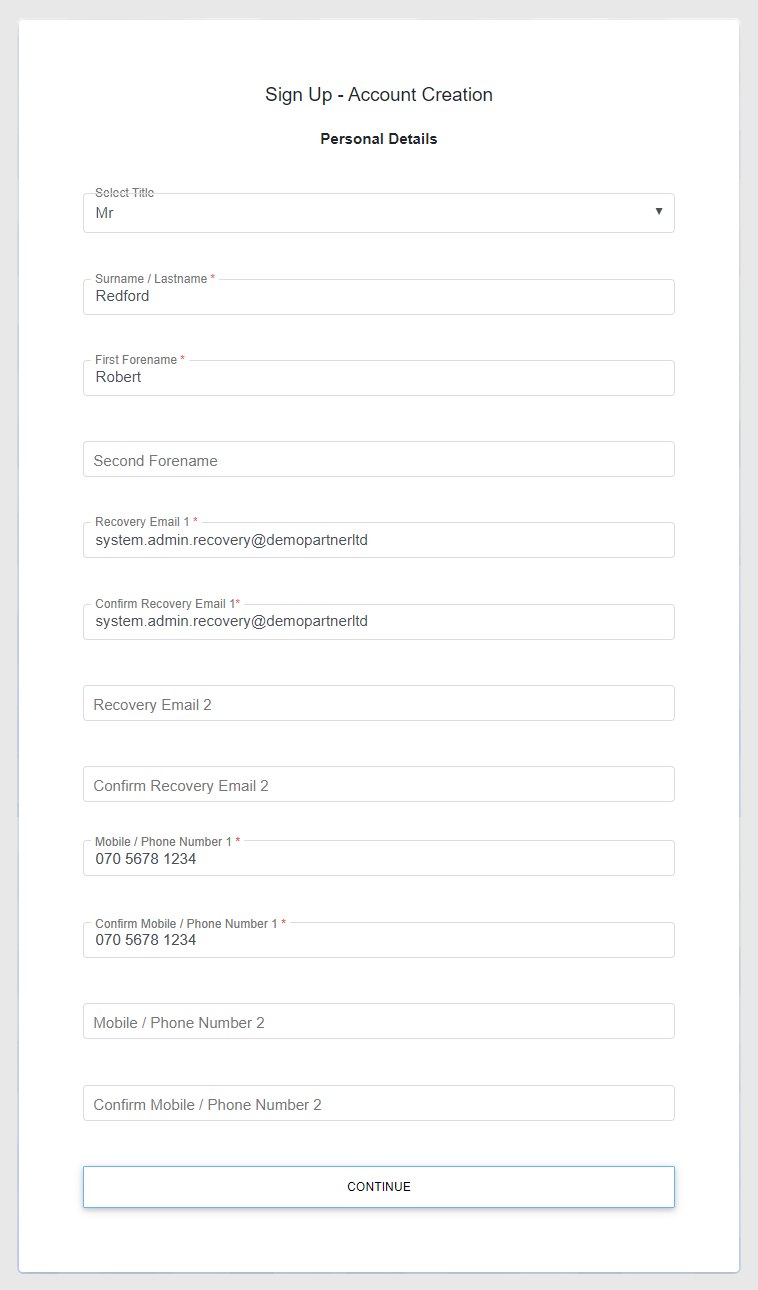

- Provide your personal details and click on the Continue button.

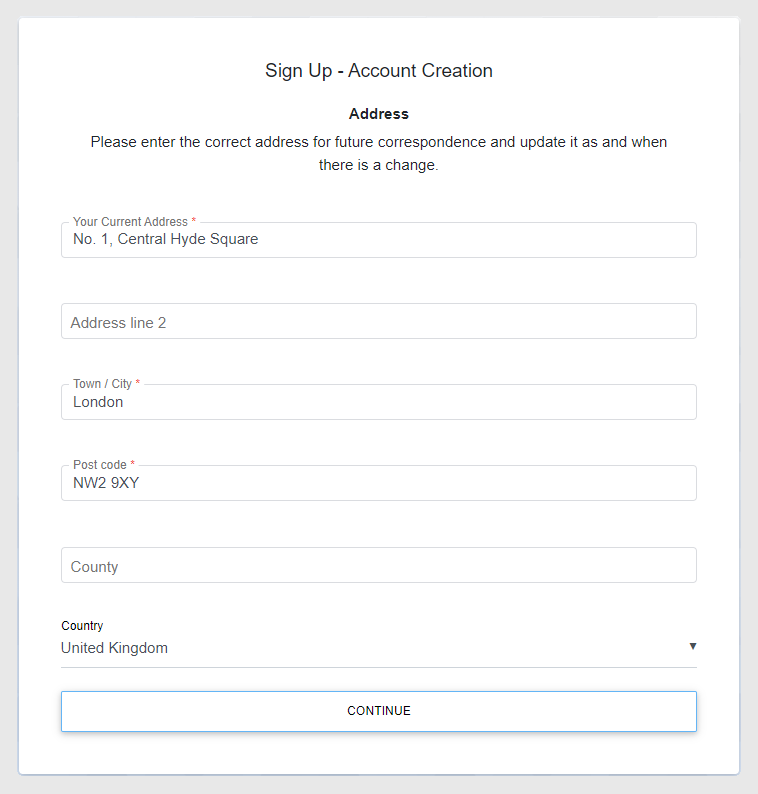

- Enter your address for future correspondence and click on the Continue

button.

- You will see a successful sign-up message along with the Sign In page.

A2) Sign In

Log in to 1asimplepayroll.com and request an API link.

- Sign into your user account first by providing your Account Email,

Account Access Code, and clicking on the Continue to Sign In button.

Note: You can obtain your Account Access Code by signing into our Tronc Payroll Mobile App and registering your mobile device as shown in C1 in the Appendix section.

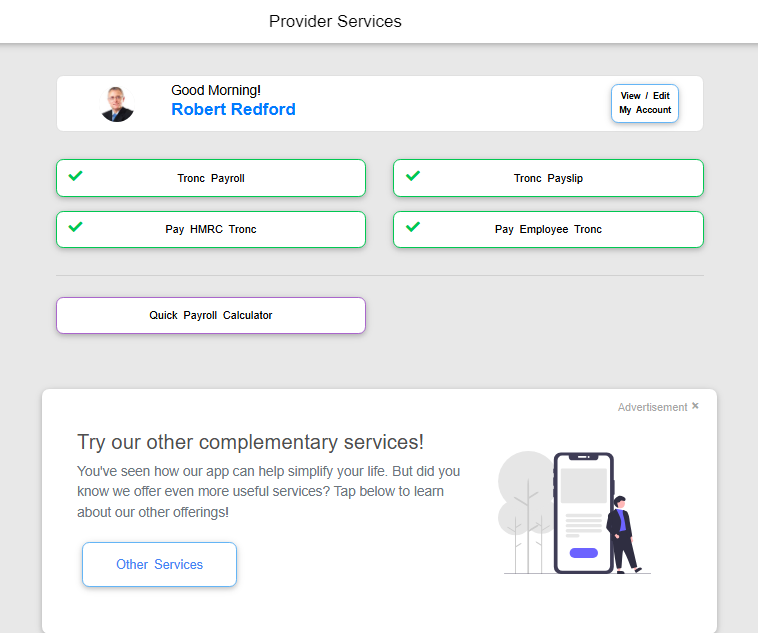

- Upon successfully signing into your account, you will see a dashboard

page.

A3) Provide Data

Log in to 1asimplepayroll.com to provide the mandatory and desired data.

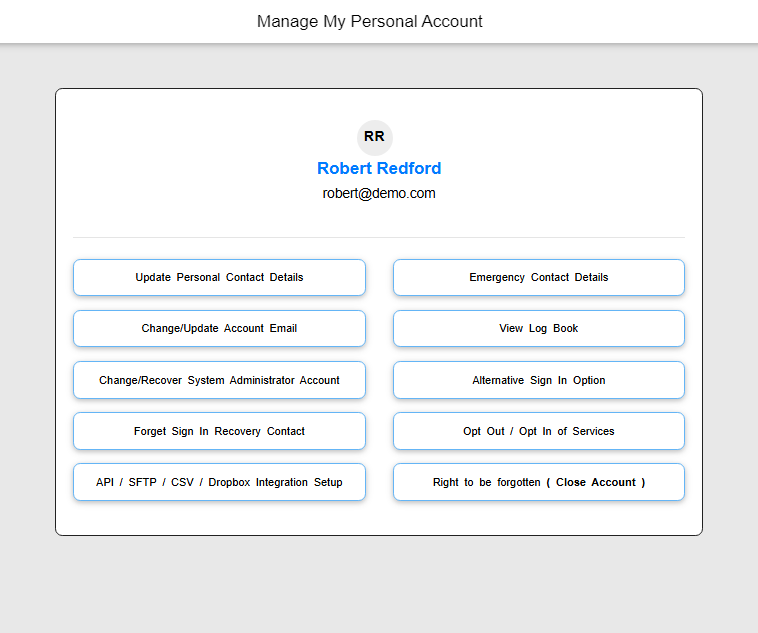

- After signing into 1asimplepayroll.com, click on the View / Edit My

Account button on the dashboard page to request API onboarding.

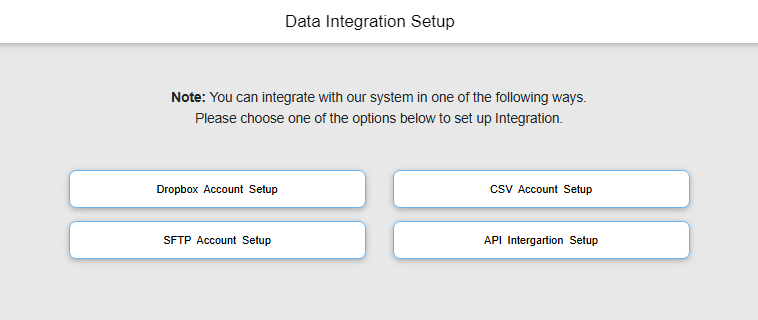

- Click on the API/Dropbox Integration Setup button.

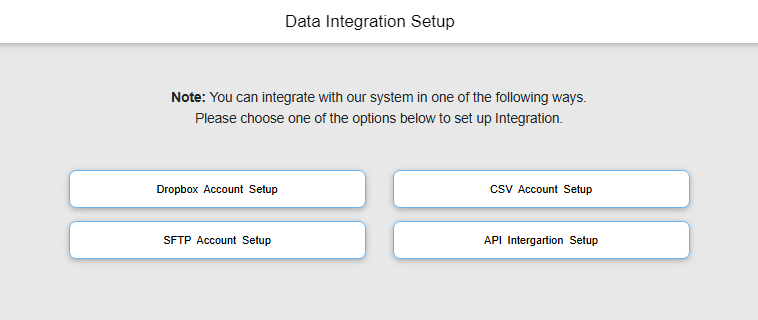

- Click on the API Integration Setup button.

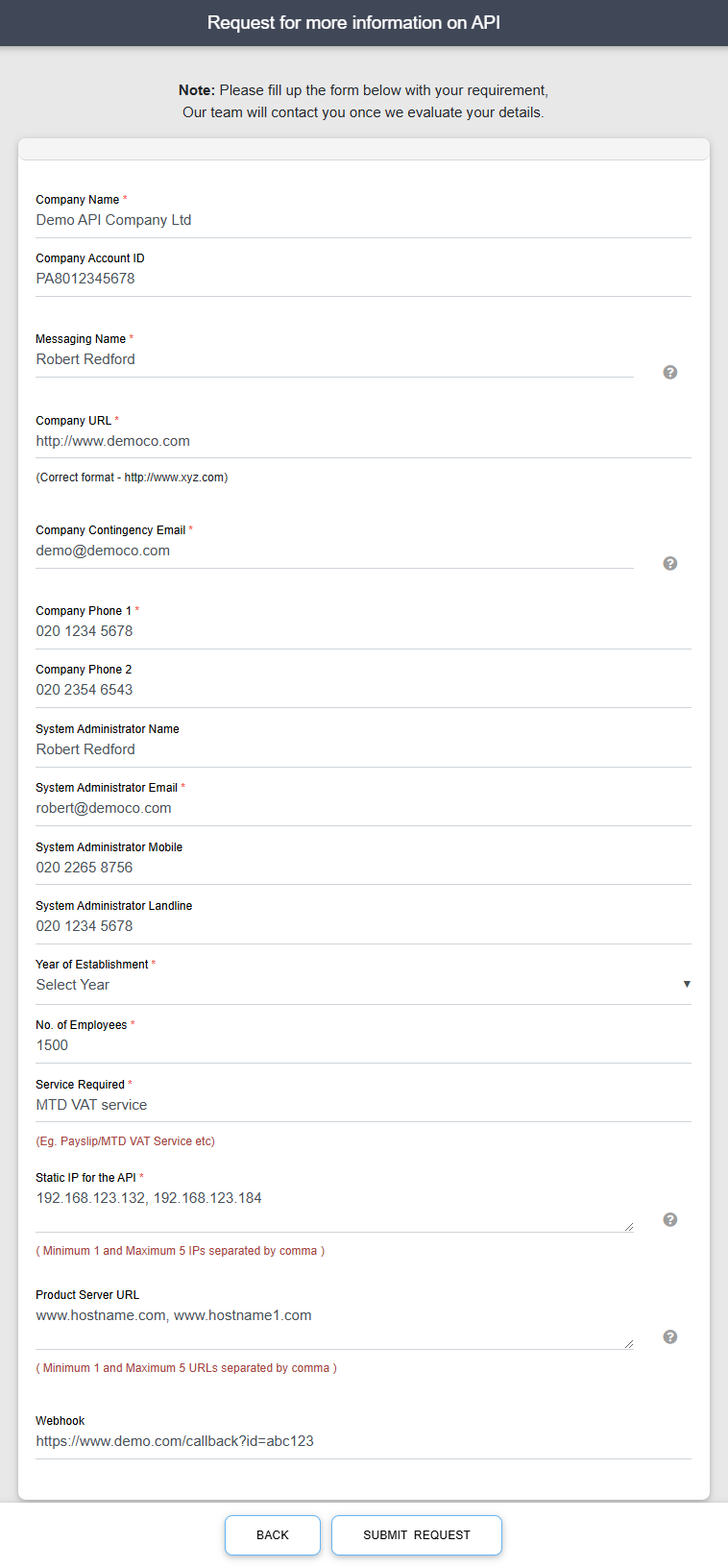

- Provide all relevant information and click on the Submit Request

button.

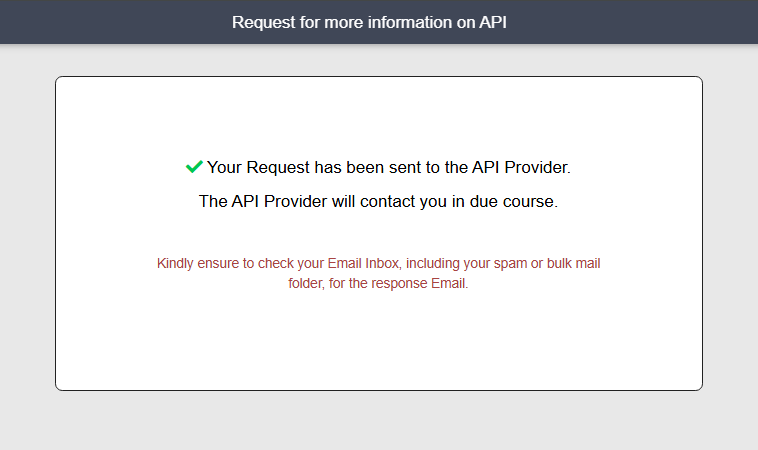

- You will see an acknowledgement page stating your request has been sent

to the API provider for approval.

A4) Obtain API Link Codes

Log in to 1asimplepayroll.com to obtain your API link codes.

- After obtaining approval to use our APIs, sign into 1 A Simple Payroll

and click on API Integration Setup.

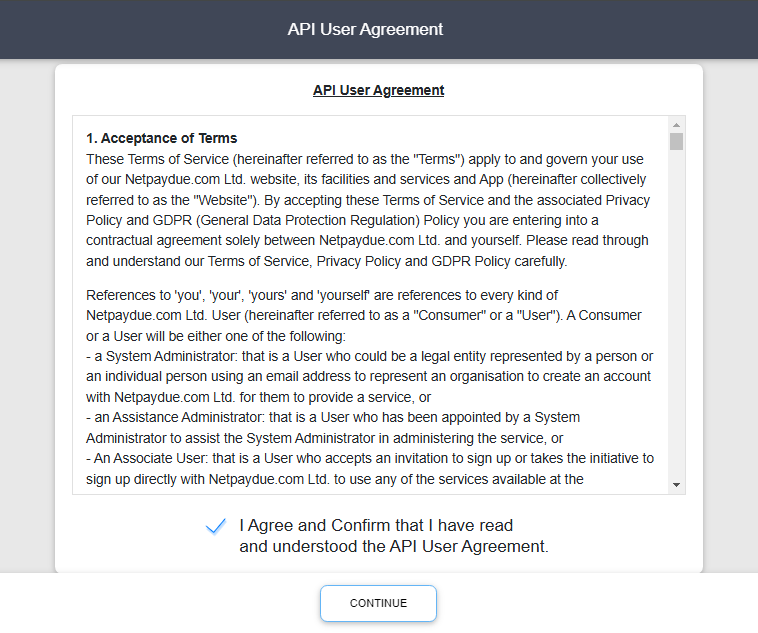

- Accept the API user agreement and click on the Continue button.

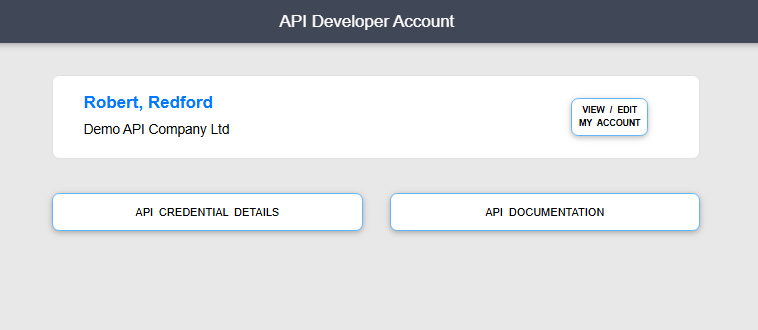

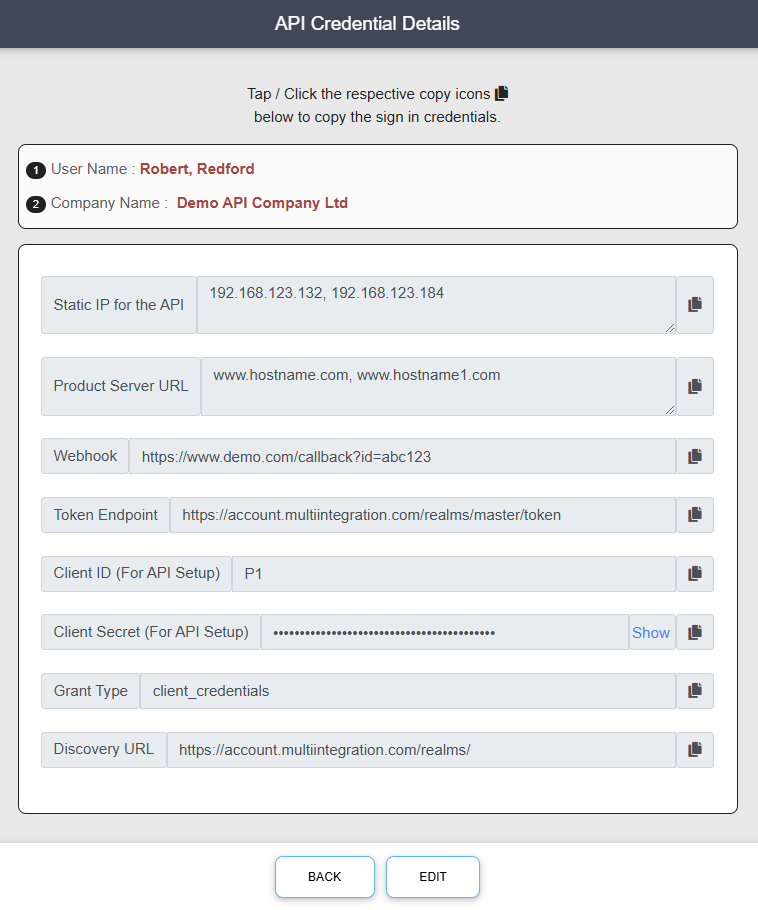

- Click on the API Credentials Details button to get OpenID client

credentials.

- You will see OpenID client_id, client_secret, and grant_type values.

Use these at your side to invoke our Authorisation API to get an access token and then use

that access token along with business data to subsequently invoke our business APIs.

A5) Install Link Codes

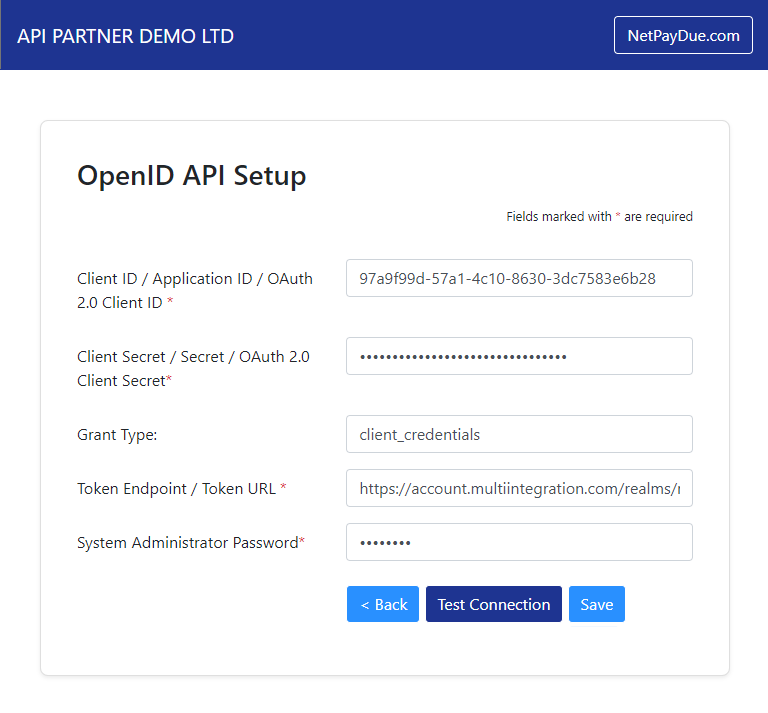

Input API Link Codes at your Partner System using OpenID Connect.

- Sign into your partner system

- Open your OpenID Connect page

- Enter all the link codes you got from 1 A Simple Payroll API credential details page

- A possible Partner OpenID Connect layout Page.

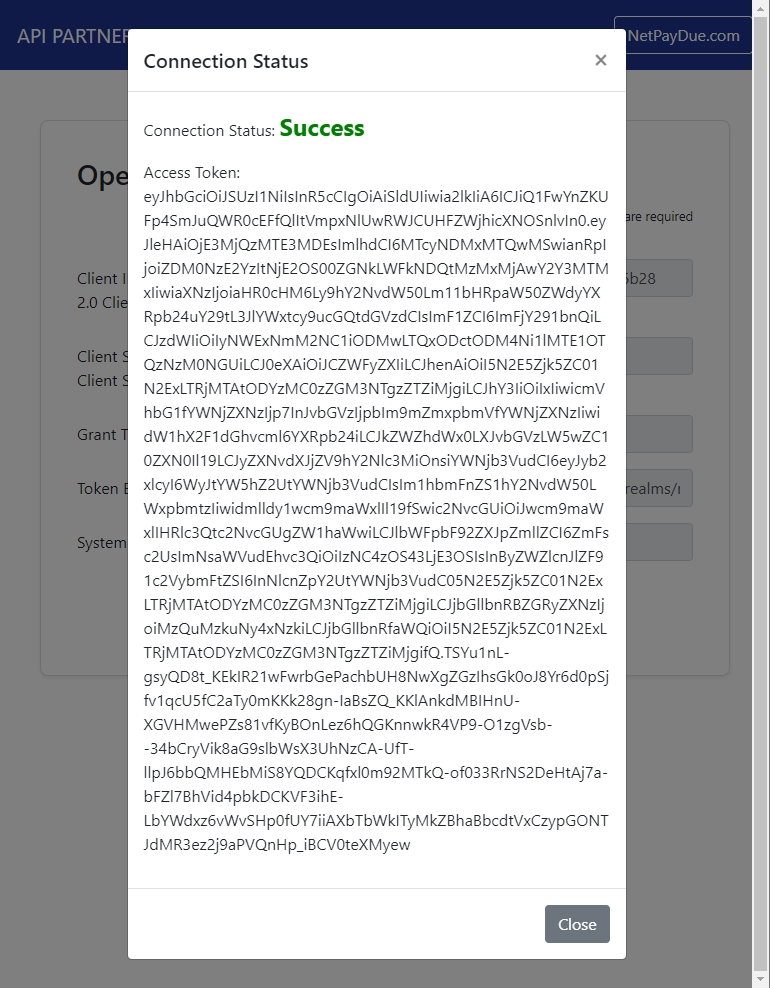

A6) Test API Link

Test the API link to ensure it is working correctly.

- A sample access token obtained from Authorisation API by using API

client credentials.

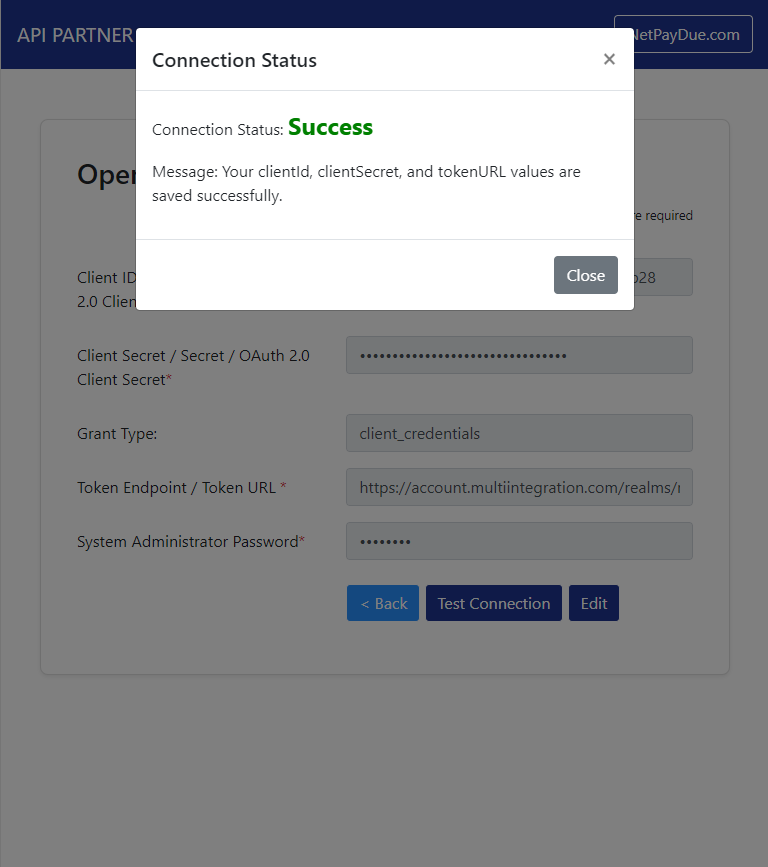

- Click on the Save button to save client credentials temporarily in the

session within our API Consumer Demo application. You will see credentials saved as

below.

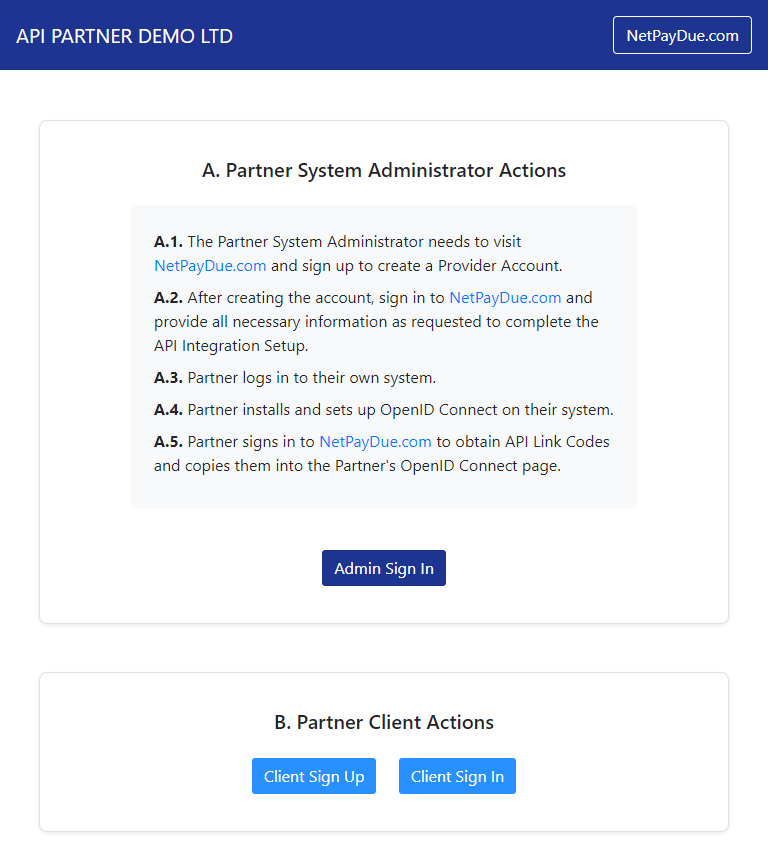

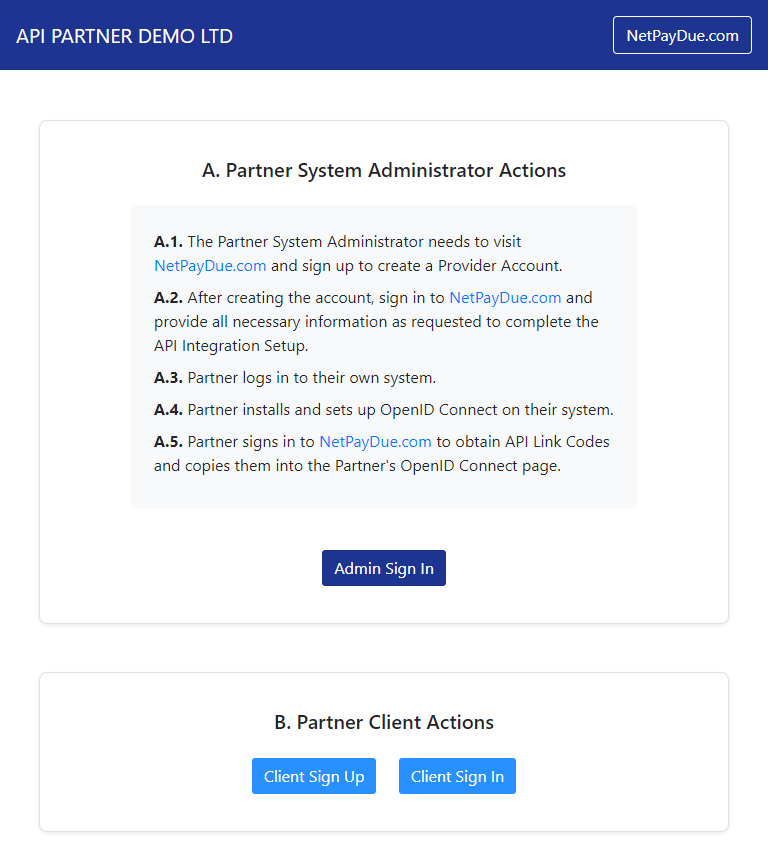

- Now, you are ready to consume our business APIs. To test if you are

able to consume one of our business APIs, set up a client by going to the starting page of

our API Consumer Demo application.

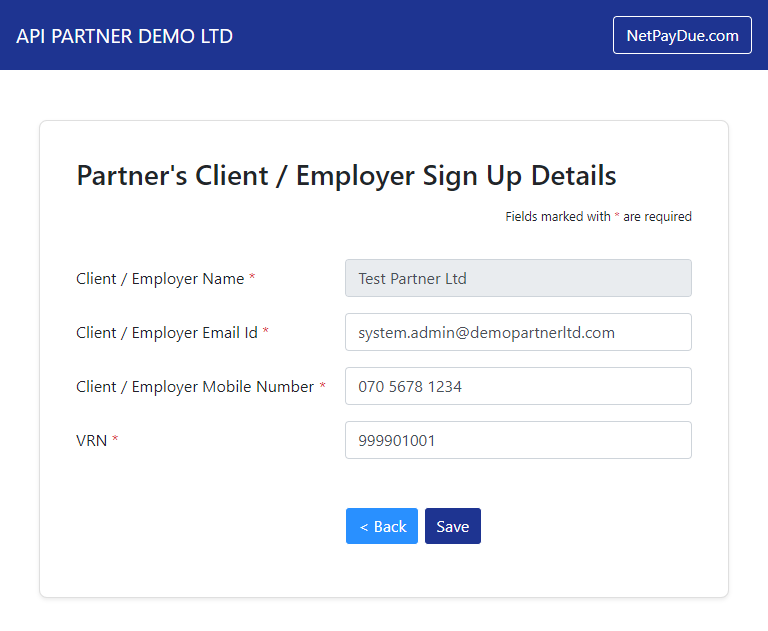

- Click on Partner Client’s Sign Up and provide Partner Client’s Email

Id, Mobile Number and VRN number and then click on Save button.

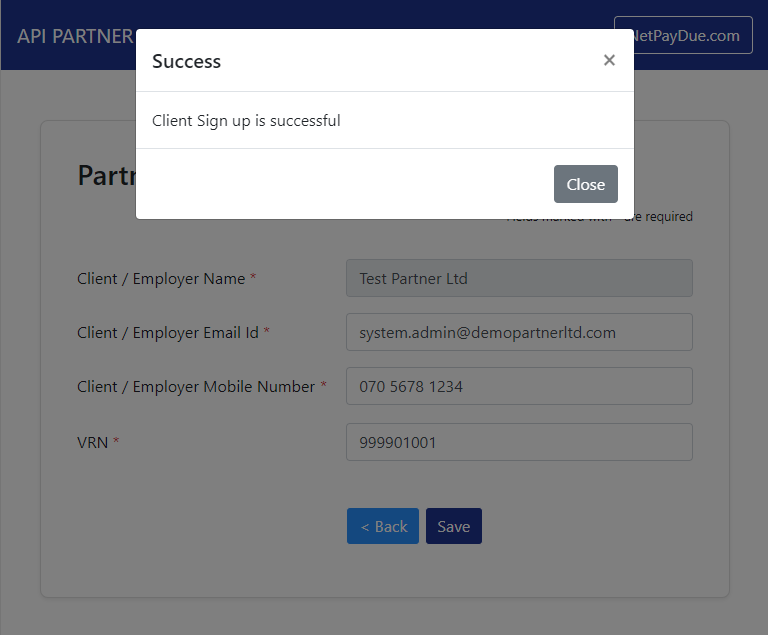

- You will get an acknowledgement that client details are saved as

below.

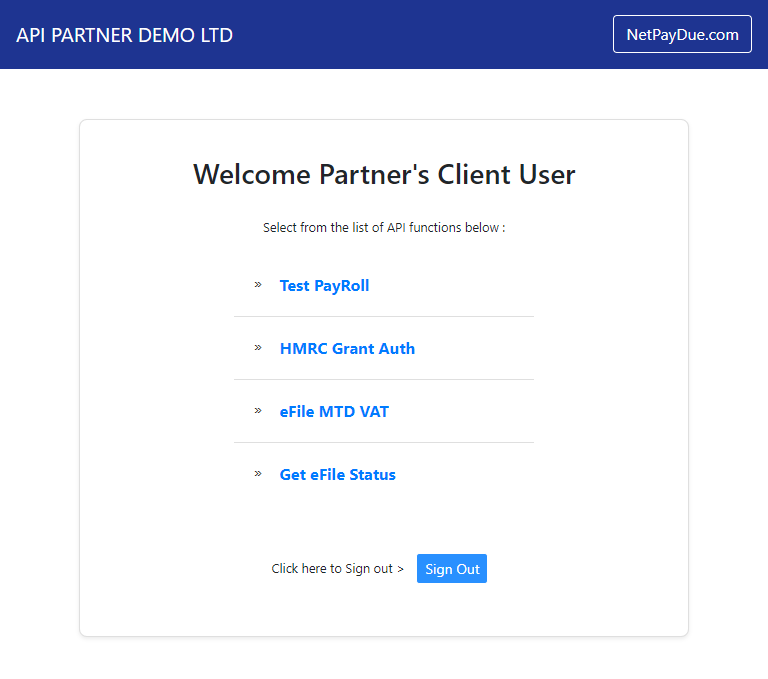

- Now, click on Partner Client’s Sign In button.

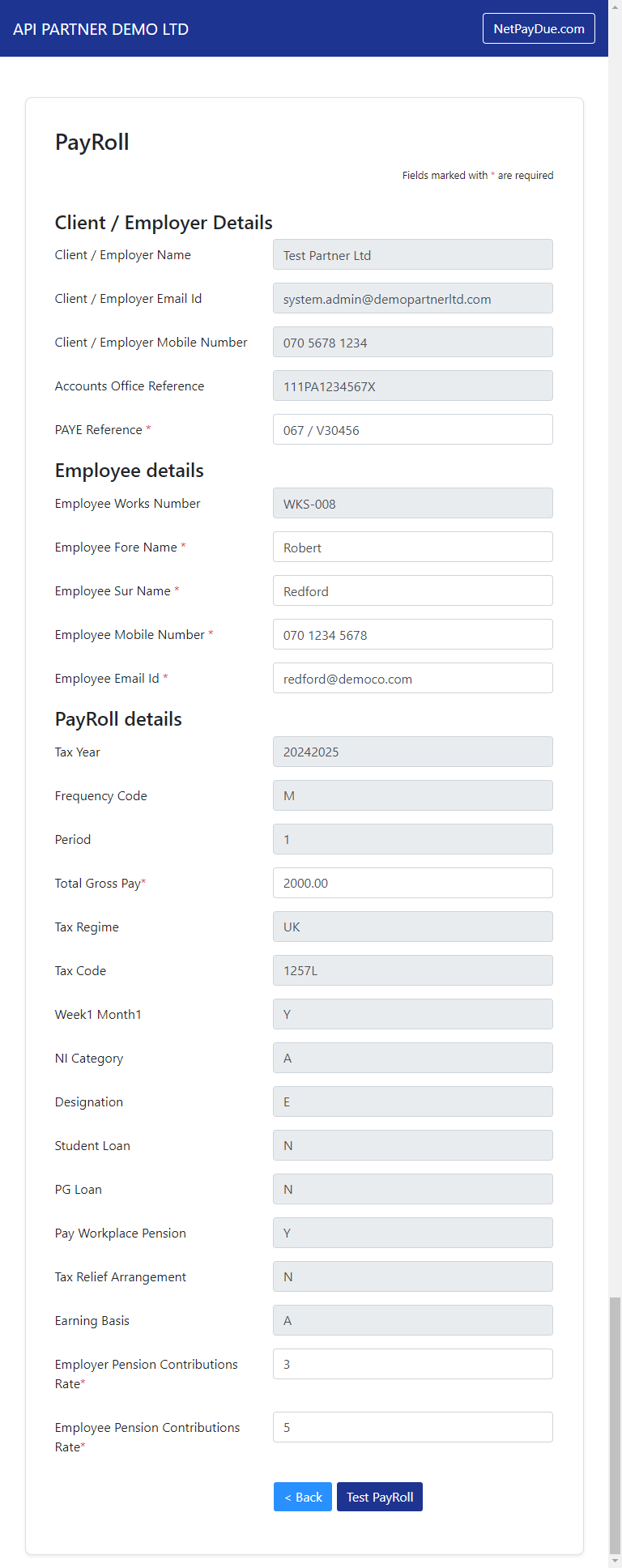

- Click on Test Payroll link.

- Enter all the relevant details and click on the Test Payroll button to

call our business API to calculate the details instantly.

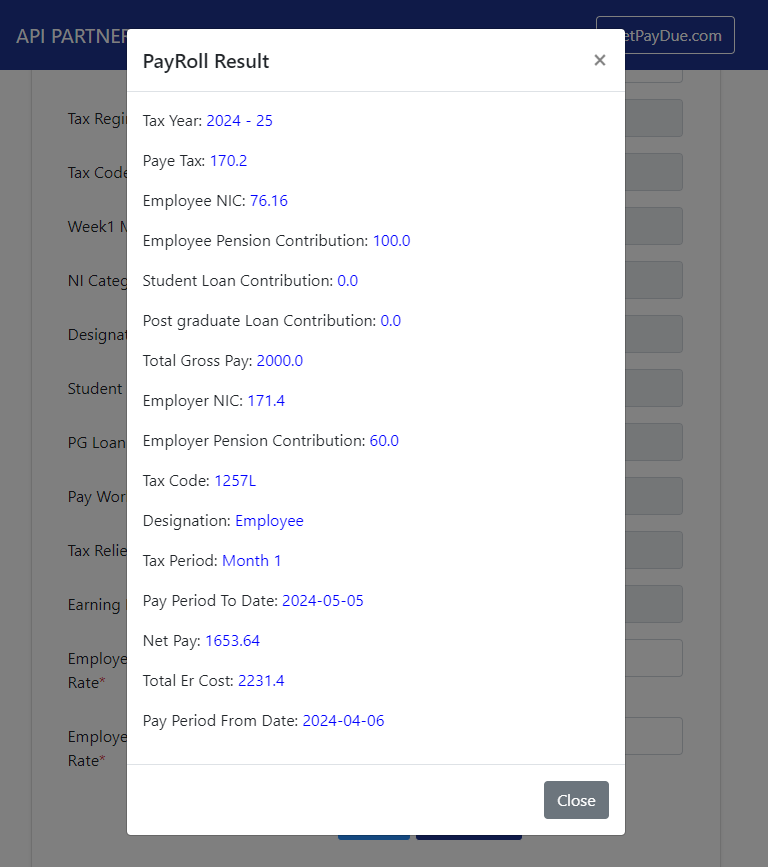

- A sample calculated results is shown below.

A7) Troubleshooting and Updates

Perform any necessary troubleshooting and updates.

- If you face issues getting an access token, verify the OpenID client credentials.

- If you face issues invoking the business API, ensure you are invoking from pre-arranged static IPs configured within 1 A Simple Payroll.

If you need any further assistance, our support team is always ready to help.

B. Business API Integration

1 A Simple Payroll offers various business APIs tailored to different applications. Each business API is designed to meet specific solution requirements systematically. Please choose the required business API and follow the respective instructions provided.

Example Business APIs:

B1) Test Payroll API

Use this API to handle and process payroll calculations.

For the complete list of all business APIs, please click on API Documentation

Conclusion: We hope this guide provides you with a clear understanding of the API integration process with 1 A Simple Payroll. By following the step-by-step instructions and referring to the provided screenshots, you can easily set up and utilise our APIs. If you need any further assistance, our support team is always ready to help. Thank you for choosing 1 A Simple Payroll for your integration needs.